Not addressing every possible issue will require corporate financial executives, auditors, regulators and other interested parties to recognize that professional judgment must play a more important role in financial reporting. At the same time, corporations and auditors, in particular, must continue to earn the trust of users of financial statements that judgment will not be abused. Also, all interested parties, not just the FASB, must assume a large part of the responsibility for simplification. They must make specific suggestions on how to simplify individual standards as well as the overall reporting framework without diminishing the quality of information to users.

Comparative Analysis with Modern Standards

The primary objective of CAP was to address the inconsistencies and ambiguities in accounting practices by issuing ARBs, which served as authoritative guidance for accountants. The main reason for the increase in the volume and complexity of accounting guidance is that many auditors, corporations and regulators ask for it. While most business people and senior partners of audit firms support general principles in theory, they often ask for much more detailed standards in practice. However, one drawback is that the statement runs 245 pages long, much of it among the most complex text of any accounting standard to date. Later, in 1973, the Financial Accounting Standards Board (FASB) was established as the new independent standard-setting body in the U.S., replacing the APB.

Example of Accounting Research Bulletins

The limitations of ARBs became increasingly apparent, particularly as new financial instruments and complex transactions emerged. This necessitated the establishment of a more formalized and structured approach to standard-setting, leading to the creation of the Accounting Principles Board (APB) in 1959. They aimed to enhance the credibility of the accounting profession by promoting ethical practices and professional judgment.

Be prepared for tax season early

It emphasized that the primary basis of accounting for inventory is cost, which is defined as the sum of the applicable expenditures and charges directly or indirectly incurred in bringing an article to its existing condition and location. Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year. Many pages of Statement no. 133 are devoted to examples of how the standard applies in certain contexts. However, accountants must carefully read and understand all 245 pages to ensure that the statement is adopted properly, a formidable challenge even for those relatively few accountants with a good understanding of derivatives.

- Explore the historical evolution, impact, and future directions of Accounting Research Bulletins on financial reporting and international practices.

- But perhaps the best explanation for creeping complexity of accounting standards is that business itself has become so much more complex.

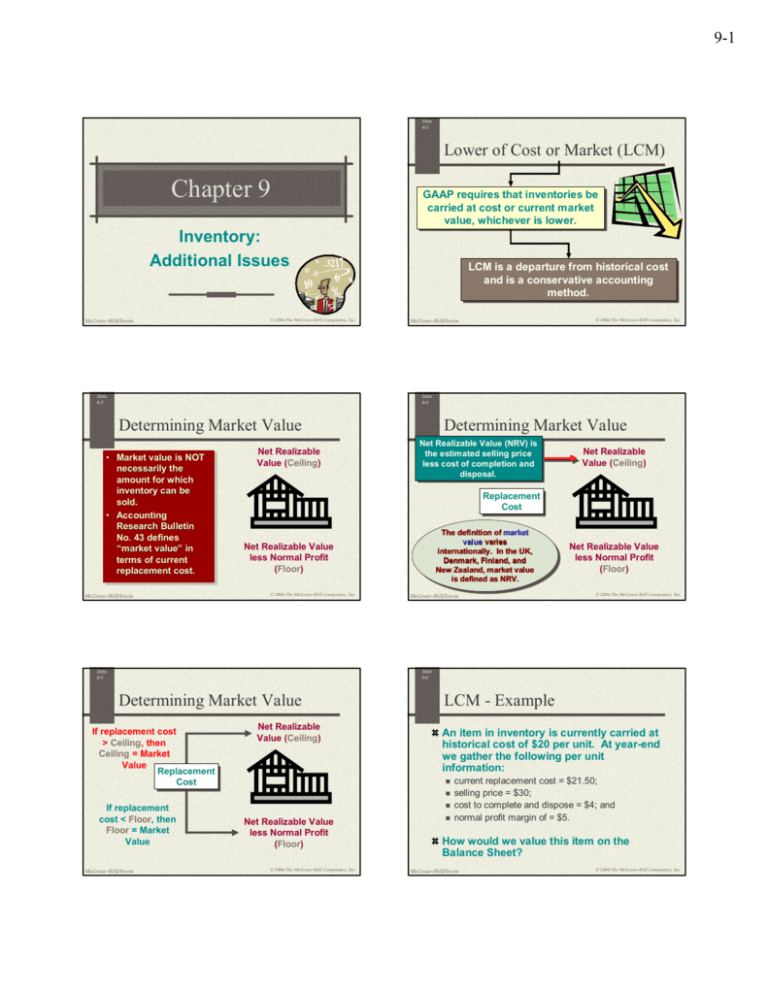

- ARB No. 43, along with other ARBs, played an essential role in shaping accounting practices in the United States during its time.

- However, the ARBs were criticized for being based on individual cases and lacking a coherent framework or a set of underlying principles.

The SEC also tends to seek the maximum in uniform application of accounting standards, even those that include inherently subjective aspects. Many of the issues brought before the EITF result from specific requests for clarification from the SEC accounting staff. Sometimes they come about because the SEC challenges a accounting research bulletin no 43 particular registrant or accounting firm and the registrant or firm asks the EITF to resolve the differences of opinion. In addition to the length and complexity of Statement no. 133—or more likely because of them—FASB had all the Big Five accounting firms help it prepare an educational course on the new standard.

How Liam Passed His CPA Exams by Tweaking His Study Process

A FASB-sponsored derivatives implementation group began meeting in early September and is expected to develop even more detailed interpretations. The FASB’s emerging issues task force (EITF) and the SEC accounting staff may weigh in with still more guidance in time. Despite the APB’s efforts, criticisms persisted regarding the lack of independence and the perceived influence of vested interests. These concerns ultimately led to the establishment of the Financial Accounting Standards Board (FASB) in 1973.

This shift was driven by the recognition that piecemeal guidance was insufficient to address the growing complexity of financial reporting. The APB’s work culminated in the issuance of 31 Opinions, which provided more detailed and prescriptive guidance on a wide range of accounting issues, from lease accounting to the treatment of extraordinary items. Before this bulletin, there was no uniform method for accounting for income taxes, leading to significant variations in financial reporting. ARB No. 48 introduced the concept of interperiod tax allocation, which required companies to recognize the tax effects of temporary differences between financial and taxable income. This approach provided a more accurate representation of a company’s financial position and performance, thereby improving the quality of financial information available to investors and other stakeholders. The Committee on Accounting Procedure was an early standard-setting body in the United States and aimed to improve accounting practices and increase consistency and comparability among financial statements.

The FASB developed the Generally Accepted Accounting Principles (GAAP), which is the current framework for accounting standards in the United States. Over time, many of the ARBs were superseded or incorporated into the GAAP framework as accounting standards evolved. One example of an Accounting Research Bulletin (ARB) is ARB No. 43, “Restatement and Revision of Accounting Research Bulletins,” which was issued in June 1953.